| NOTICE OF |

|

20232024 Annual Meeting of

Stockholders and Proxy Statement

Wednesday,Thursday, June 14, 202320, 2024

9:00 a.m. Eastern Time

To be held online atat:

www.virtualshareholdermeeting.com/BIIB2023BIIB2024

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. |

| NOTICE OF |

|

20232024 Annual Meeting of

Stockholders and Proxy Statement

Wednesday,Thursday, June 14, 202320, 2024

9:00 a.m. Eastern Time

To be held online atat:

www.virtualshareholdermeeting.com/BIIB2023BIIB2024

| ||||

April 28, 202326, 2024

To MyDear Fellow Stockholders:Stockholders

OverLast year, the last nine years as Chair, I have seen extraordinary changes at bothfirst full year under the leadership of our current Chief Executive Officer (CEO), Biogen and in our industry. As I reflectfocused on my final letter to you in this role, I take pride both in wheredelivering for stockholders by delivering for patients:

In April we have been as a company, and where we are headed as we implement new strategies to return Biogen to sustainable growth. My pride is rooted in our commitment to pioneering therapies for hard-to-treat diseases. As you will read in this report, we continued to make strong progress on that mission in 2022. My optimism is based on our pipeline of new medicines to meet critical unmet needs, and our intense focus on strengthening our discipline on costs and focusing on achieving meaningful returns on all our investments. I would be remiss if I were not to share with you my disappointment with the many challenges we have faced in trying to launch Aduhelm.

In 2022, we advanced several significant potential growth drivers, including two therapies that were granted Priority Review by thereceived accelerated U.S. Food and Drug Administration (FDA) – LEQEMBI, which received accelerated approval in January 2023 and is being co-developed with our partner Eisai Co., Ltd. (Eisai), and zuranolone, which is being co-developed with our collaboration partner Sage Therapeutics, Inc. (Sage). Each are examples of our ability to advance innovative medicines with the potential to achieve significant results for patients in areas of high unmet need.

LEQEMBI is only the second approved Alzheimer’s disease therapy to target a pathological hallmark of the disease in the last 40 years and potentially the first anti-amyloid antibody to receive traditional approval. Zuranolone, if approved, would provide an important new, rapid-acting option for the potential treatment of major depressive disorder (MDD) and postpartum depression (PPD). These are the kind of breakthroughs that Biogen is capable of achieving and has done so repeatedly in the past.

At the same time, we remained committed to our multiple sclerosis business and bringing these important medicines to patients globally. We also continued to advance SPINRAZA, the first treatment for spinal muscular atrophy (SMA) launched in 2016, which is now approved in 69 countries and has improved the lives of thousands of patients. Finally, in April 2023 QALSODY, was approved as a therapy to treat amyotrophic lateral sclerosis (ALS) in patients who possess the superoxide dismutase 1 (SOD1) mutation and this represents the first treatment to target a genetic cause of amyotrophic lateral sclerosis (ALS) in adults who have a mutation in the superoxide dismutase 1 (SOD1) gene. QALSODY became commercially available shortly thereafter.

In July we announced the acquisition of Reata Pharmaceuticals Inc. (Reata), adding SKYCLARYS – which had just received FDA approval as the only treatment indicated for patients with Friedreich’s ataxia –to our global portfolio of treatments for neuromuscular and rare diseases.

Also in July, we and our collaboration partner Eisai Co., Ltd. (Eisai) received traditional FDA approval of LEQEMBI, an anti-amyloid antibody for the treatment of Alzheimer’s disease which had received accelerated approval six months earlier. Subsequently, the Centers for Medicare & Medicaid Services (CMS) confirmed broad coverage of the treatment. LEQEMBI was also approved in Japan in September.

| • | In August we and our collaboration partner Sage Therapeutics, Inc. (Sage) received FDA approval for ZURZUVAE, the first and only oral, once-daily, 14-day treatment that can provide rapid improvement in depressive symptoms for women with post-partum depression (PPD). |

As our business evolves, we have worked to align our costs with our business plan as we strive to return to sustainable growth. In 2023 we launched “Fit for Growth”, an initiative that prioritized decision-making, agility, accountability and cost savings. We expect Fit for Growth to achieve approximately $1 billion in gross cost reductions by the end of 2025, and this devastating disease.initiative has enabled us to reinvest part of those savings in key growth drivers, new capabilities and potential future medicines.

AtOver the same time, aslong term, our success will also require more than merely doing excellent science, bringing important therapies to market, and managing for continued financial strength. Biogen aspires to be a purpose-driven company,positive presence wherever we believe serving humanityoperate, building stronger and healthier communities through science has never mattered more. Foremployee volunteerism, grants from the Biogen that includes bolstering our commitmentFoundation, and programs like Community Labs, which introduces students to the wonders of science. We also remain committed to advancing health equity and caring deeply about making a positive difference for patients, our employees,by helping people who are underrepresented or underserved gain access to quality health care at every stage of the environment and the communities where we live and work. Our approach to environmental sustainability, social responsibility and corporate governance, or ESG, begins with our mission to serve patients and is supported by our long-standing focus on using resources responsibly to support the sustainability of our business. Through patient assistance programs, expandedjourney. We are providing access to investigational therapies, and other initiatives, we have developed patient programs to assist eligible patients around the world to obtain the medicines they need. We increased our focus on diversity, inclusion and belonging, including by working to improve the diversity and representationincreasing participation of racial and ethnic minorityunderrepresented populations in clinical trial research.trials and supporting Early Access Programs (EAP) and compassionate use initiatives.

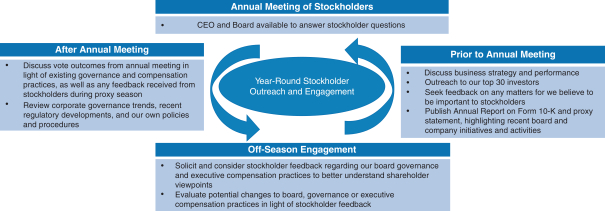

Finally, ourAs I close my first year as the Chair of the Board (Board), I want to thank my predecessor Stelios Papadopoulos for the strong foundation he helped build. As a Board – indeed, as a global company – we benefit from diverse perspectives, backgrounds, and Board continueexperience in life sciences and global innovation. We are better able to be guided by the perspectives of ourdeliver for stockholders as expressed through our engagement with them throughout the year and at our Annual Meeting. Consistent with prior years’ practices, since our 2022 Annual Meeting, we have engaged in governance-focused outreach with stockholders holding approximately 64% of our outstanding stock. Feedback received during the course of these activities informs Board decisions. I know our commitment to continuing this valuable dialogue with our investors will not change.

On behalf ofbecause our Board has both the willingness to embrace, and the capabilities to address, the challenges Biogen will face as we focus on returning to sustainable growth. Over the past year we continued to burnish both of those strengths by refreshing the leadership of the Board and the membership and leadership of the committees, and – as of January 2024 when Monish Patolawala, the President and Chief Financial Officer of 3M Company, joined the Board – by adding two new independent directors since the beginning of 2023.

Together with my colleagues on the Board and the executive leadership team, I thanklook forward to helping Biogen deliver more for patients and for stockholders in 2024 and beyond. Thank you for your participation and investment in Biogen. I could not be more confident about the future under the leadershipcontinued support of Christopher Viehbacher, a proven biotech executive and great leader as our new President and Chief Executive Officer and Caroline Dorsa, a seasoned veteran of the industry and our board, who will assume the position of Chair after the Annual Meeting.

Very truly yours,efforts.

Caroline Dorsa

STELIOS PAPADOPOULOS, Ph.D.

Chair of the Board

On behalf of the Board of Directors of Biogen Inc.

Our Track Record of Responsiveness to Stockholder Feedback

Our Track Record of Responsiveness to Stockholder Feedback

Our Board values the views of our stockholders and other stakeholders, and we solicit input from them throughout the year. In line with past practice, we sought and received detailed feedback from our stockholders after the 2023 Annual Meeting. We received feedback on a range of topics including specific aspects of our business strategy, capital allocation, corporate governance, executive compensation and our Environmental, Social and Governance (ESG) initiatives. The stockholder engagement calls were led by our Board and Corporate Governance Committee (CGC) Chair and attended by the Chairs of the Compensation and Management Development Committee (CMDC) and/or Audit Committee and/or other independent directors.

Stockholder Outreach Following the 2023 Annual Meeting | ||||

We reached out to our top 40 stockholders who collectively owned:

| 65%

| Which included 20 stockholders who voted Against 2023 Pay | ||

We had 15 discussions with stockholders who collectively owned: | 47% of | Which included 7 stockholders who voted Against 2023 Say on Pay | ||

Independent Directors, including our Board and CGC Chair, and Chairs of the CMDC and/or Audit Committee | Participated in 100% of these calls | |||

The feedback and perspectives received from stockholders during these meetings were shared with the Board and served as an input to discussions at the Board and its committees, and ultimately informed decisions we made and actions we took.

The table below provides a summary of the recent feedback we received from stockholders, and how the Board incorporated that feedback into its actions and how these actions protect and enhance stockholder value.

1 As of December 31, 2023.

2024 Proxy Statement 2024 Proxy Statement | -i- |

Our Track Record of Responsiveness to Stockholder Feedback

Stockholder Feedback “What We Heard”

| Actions Taken “What We Did” | Impact of Action “Why It Is Important” | ||||

| Incentives should reward executives for company performance and align payouts with stockholder value creation | ✓ 92% of CEO 2024 pay and 83% of our current named executive officers (NEOs) 2024 pay is linked to either performance against preset goals or stockholder value creation | ✓ Supports continued focus on the company’s strategy ✓ Supports alignment of interests between NEOs and stockholders | |||

✓ For 2024 LTI grants, added an operationally focused metric based on the compound annual growth rate of our adjusted earnings per share (EPS) weighted at 50% of PSU performance

| ✓ Better align incentive payouts with long-term company performance by providing a more balanced measurement of company performance | ||||||

| Some stockholders voiced their preference for a simpler bonus plan framework, and that annual performance plan metrics should measure more than just financial performance, with pipeline metrics being commonly supported. There was mixed support for ESG metrics, and stockholders voiced support for continued market access expansion | ✓ The 2024 Annual Bonus Plan continues to go beyond financial performance measurement, including pipeline, health equity and diversity, equity and inclusion (DE&I) metrics. ✓ The 2024 Bonus Plan contains a simplified framework linking short-term compensation with performance. ✓ The 2024 Bonus Plan’s ESG goal includes metrics focused on clinical trial diversity, expanding global market access for spinal muscular atrophy (SMA) patients, and workforce DE&I initiatives | ✓ Aligns NEO focus on broad short-term goals which supports long-term performance ✓ Annual bonus plan multiplier is based on company performance which is assessed against quantifiable preset goals focused on financial performance and pipeline value creation | ||||

| Many stockholders expressed dissatisfaction with the disclosure we provided about the Board changes in connection with the 2023 Annual Meeting and our process for choosing nominees to serve on the Board |

✓ Enhanced process used to identify, assess and nominate a new director in November 2023 | ✓ Goal is to ensure that the Board has the skills, backgrounds, diversity and experience necessary to fulfill its responsibilities and provide independent oversight of management ✓ Supports independent, comprehensive and transparent Board search and nomination process | |||

| Greater transparency regarding our Board and management succession planning, Board refreshment practices | ✓ Since the 2023 Annual Meeting we have changed our Board Chair and the Chairs of all of our standing committees ✓ Added 5 of our independent directors since 2019 ✓ Eliminated age-based offer of resignation policy ✓ New director tenure policy seeks to maintain an average tenure of 10 years or less for independent directors | ✓ Board is constantly evaluating its membership to determine that it has the right mix of skills, backgrounds, diversity and experience ✓ New director tenure policy supports more deliberate Board succession planning based on annual assessment of director skills and experiences rather than the offer of resignation required under our former age-based policy |

2024 Proxy Statement 2024 Proxy Statement | -ii- |

Our Track Record of Responsiveness to Stockholder Feedback

| ✓ Added additional disclosure regarding our Board and management succession planning and Board refreshment practices | ✓ Provides greater transparency to our stockholders regarding our Board and management succession planning and Board refreshment practices | |||||

| Ensure directors have the time to focus on oversight responsibilities | ✓ Reduced the number of public company boards our non-CEO directors are allowed to serve on to 4 from 5 (Biogen plus three outside public company boards; our CEO can serve on one public company board) | ✓ Goal is to ensure that each director has sufficient time to focus on the needs of the Board |

Board Actions Rationale

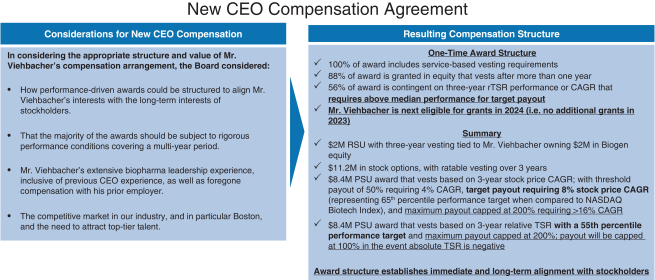

Executive Compensation: During post-2023 Annual Meeting stockholder engagement, many stockholders conveyed a preference that our performance incentives include metrics that provide a more balanced assessment of company performance.

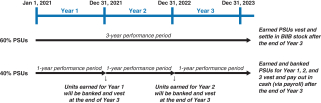

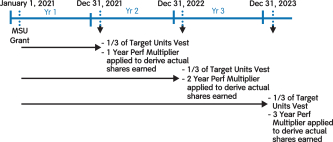

When evaluating changes to the design of our PSUs and informed by stockholder feedback, the CMDC added an operationally focused performance goal based on a three-year adjusted non-GAAP EPS that would further strengthen the link between pay and company performance. Further, the CMDC expanded the rTSR comparator group to better align with market practices. Finally, for 2024, the CMDC increased the weighting of PSUs to comprise 60% of LTI equity grants.

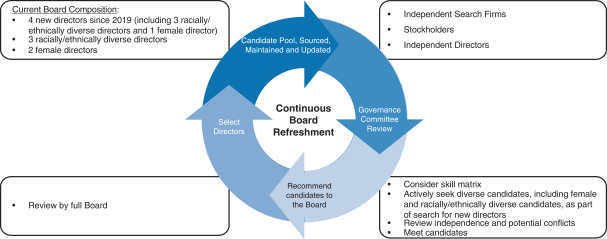

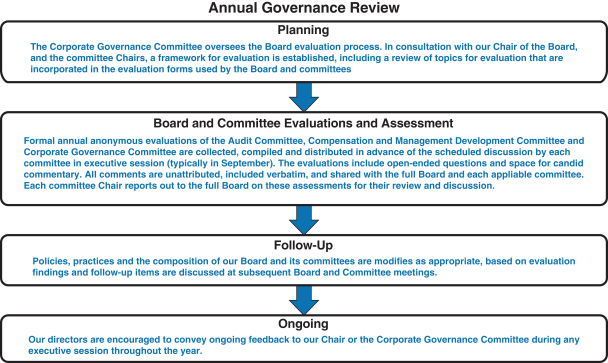

Corporate Governance: Many stockholders voiced dissatisfaction with the disclosure we provided about Board changes made in connection with the 2023 Annual Meeting and the level of disclosure about the process we used for choosing nominees to serve on the Board. In addition, stockholders requested more disclosure about Board and management succession planning, and the Board’s refreshment practices.

Informed by stockholder feedback, we made a range of changes to our corporate governance policies and practices. You will also see additional disclosure in this proxy statement about these changes.

The CGC, led by its new Chair, adopted an enhanced nomination process to identify candidates that possess the skills, background, diversity and experience to contribute to the Board and its committees. Our enhanced process begins with an assessment by the CGC of the skills and experience needed on the Board and leverages independent search firms to access a broad network of candidates and evaluate and conduct diligence on potential candidates. Potential candidate(s) are made available to be interviewed by all members of the Board prior to being nominated by the CGC for approval by the Board. Our newest director, Monish Patolawala, was identified and appointed to the Board under this updated process.

Additionally, we expanded our disclosures regarding our Board refreshment practices and Board and management succession planning processes. To enable a more deliberate Board succession planning process, after the 2023 Annual Meeting, the Board eliminated the bright-line age-based offer of resignation policy in favor of seeking to maintain an average tenure of 10 years or less for our independent directors. The Board believes that managing for overall independent director tenure strikes a better balance between retaining directors with deep knowledge of the company and adding directors with different skills and a fresh perspective rather than simply forcing directors of a certain age to offer their resignation. We also added additional disclosures so that stockholders can better understand the actions the Board takes to support Board refreshment and Board and management succession planning.

Lastly, the Board amended our Corporate Governance Principles to reduce the number of public company boards that a non-CEO director can serve on from five to four (Biogen plus three other outside public company boards; our CEO can serve on one outside public company board). The Board made this change as a result of its review of current corporate governance trends and best practices and it was also informed by stockholder feedback.

2024 Proxy Statement 2024 Proxy Statement | -iii- |

Executive Pay Structure Aligns with Compensation Philosophy

Executive Pay Structure Aligns with Compensation Philosophy

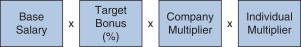

| Executive Compensation Philosophy | ||||||

| Our executive compensation philosophy is to reward executives for the creation of long-term stockholder value. We designed performance-based compensation that is competitive with our peer group to attract and retain extraordinary leaders who perform at high levels and succeed in a demanding business environment. | ||||||

| Mission Focused and Business Driven | Competitively Advantageous |

Differentiated |

Aligned | |||

| We emphasize the importance of achieving short-term goals while building and sustaining a foundation for long-term success in delivering meaningful and innovative therapies to patients | We benchmark against companies we compete with for talent and our compensation is designed to recruit, retain and motivate our leadership team to achieve their best for the company and our stockholders | We endeavor to align pay outcomes with company and individual performance and reward our best performers for exceeding expectations | We provide equity to all of our employees to align their interest with our broader interest of creating long-term value for our stockholders | |||

How Our Pay Practices Align with Our Philosophy

| Practice | Mission Focused / Business Driven | Competitively Advantageous | Performance Differentiated | Ownership Aligned | ||||

Over 85% of NEO (excluding the CEO) total direct compensation is tied to performance driven measurements | ✓ | ✓ | ✓ | ✓ | ||||

Annual bonus and LTI plan are performance-based with payouts capped | ✓ | ✓ | ✓ | |||||

LTI awards are linked to performance, subject to multi-year vesting periods, and designed to reward long-term performance | ✓ | ✓ | ✓ | ✓ | ||||

Competitive total pay opportunities relative to peer group and broader market in which we compete for talent | ✓ | ✓ | ✓ | ✓ | ||||

Annual risk assessment to ensure our compensation programs do not encourage excessive risk taking | ✓ | ✓ | ||||||

Robust stock ownership, anti-hedging and pledging, and clawback policies | ✓ | ✓ | ✓ | |||||

Stockholder feedback is a key input to Board and CMDC discussions and informs actions taken | ✓ | ✓ | ✓ | ✓ | ||||

2024 Proxy Statement 2024 Proxy Statement | -iv- |

Executive Pay Structure Aligns with Compensation Philosophy

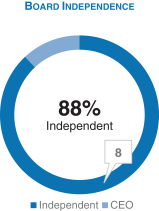

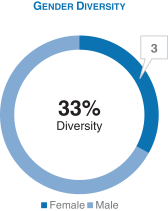

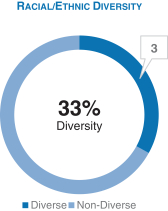

Corporate Governance Highlights | ||||

of Directors are Independent |

of Directors are Diverse | 75% of our Audit Committee Members are Audit Committee Financial Experts | 66% of Committee Chairs are Diverse | 63% of Independent Directors appointed in last 5 years | ||||

Our Board consists of 8 Independent Directors and our CEO | Our Board includes 3 female and 3 racially/ethnically diverse directors | 4 of our 8 Independent Directors are Audit Committee Financial Experts | Chairs of the Corporate Governance and CMDC are diverse | 5 of our 8 Independent Directors appointed since 2019 | ||||

| Board Composition | ||||

|  |  | ||

|

| |||

2024 Proxy Statement 2024 Proxy Statement | -v- |

Notice of 2024 Annual Meeting of Stockholders

Date: Time: Virtual Meeting: Record Date: | Thursday, June 20, 2024 9:00 a.m. Eastern Time Online only at www.virtualshareholdermeeting.com/BIIB2024 April | |

| Items of Business: | 1. To elect the | ||

2. | To ratify the selection of PricewaterhouseCoopers LLP (PwC) as our independent registered public accounting firm for |

3. | To hold an advisory vote on executive compensation. |

4. | To |

5. | To approve the Biogen Inc. 2024 Omnibus Plan. 6. To approve the Biogen Inc. 2024 Employee Stock Purchase Plan. 7. To transact such other business as may be properly brought before the annual meeting and any adjournments or postponements. |

| ||

You will not be able to attend the annual meeting in person. |

| Your vote is extremely important regardless of the number of | |

Important Notice Regarding the Availability of Proxy Materials for Annual Meeting of Stockholders To Be Held on June 20, 2024: The Notice of 2024 Annual Meeting of Stockholders, Proxy Statement and 2023 Annual Report on Form 10-K are available at the following website: www.proxyvote.com. | ||

Important Notice Regarding the Availability of Proxy Materials for Annual Meeting of Stockholders

To Be Held on June 14, 2023:

The Notice of 2023 Annual Meeting of Stockholders, Proxy Statement and 2022 Annual Report on Form 10-K

are available at the following website: www.proxyvote.com.

By Order of Our Board of Directors,

SUSAN H. ALEXANDER,Wendell Taylor,

Chief Corporation Counsel, Secretary

225 Binney Street

Cambridge, Massachusetts 02142

April 28, 202326, 2024

This Notice of 2024 Annual Meeting of Stockholders and Proxy Statement are first being sent to stockholders on or about April 28, 2023.26, 2024.

Our 20222023 Annual Report on Form 10-K is being sent with this Notice of 2024 Annual Meeting of Stockholders and Proxy Statement.

Table of Contents |

|

Table of Contents |

| 1 | |||||

| 2 | |||||

| 10 | |||||

| 10 | |||||

| 11 | |||||

Process for Selecting Directors, Director Qualifications | 11 | ||||

| 13 | |||||

| 14 | |||||

| 14 | |||||

| 14 | ||||

| 15 | |||||

| 16 | |||||

| 17 | |||||

| 17 | |||||

| 20 | |||||

Proposal 2 – Ratification of the Selection of Our Independent Registered Public Accounting Firm | 22 | ||||

| 23 | |||||

| 24 | |||||

| 24 | |||||

| 25 | |||||

| 26 | |||||

| 27 | |||||

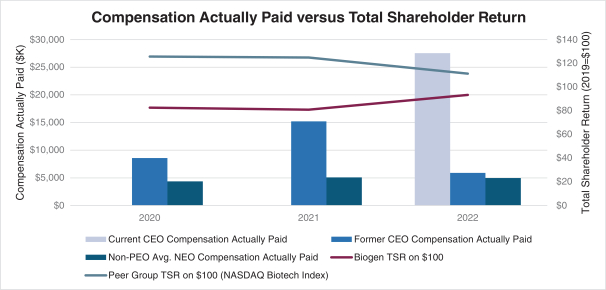

Stockholder Engagement and Responsiveness to 2023 Say on Pay Vote | 27 | ||||

| 29 | |||||

| 30 | |||||

| 30 | |||||

| 31 | |||||

| 31 | |||||

| 31 | |||||

| 32 | |||||

| 32 | |||||

| 33 | |||||

| 39 | |||||

| 43 | |||||

| 44 | |||||

| 45 | |||||

| 45 | |||||

| 46 | |||||

| 46 | |||||

| 46 | |||||

| 46 | |||||

| 47 | |||||

| 47 | |||||

| 48 | |||||

| 48 | |||||

| 49 | |||||

| 51 | |||||

| 52 | |||||

| 52 | |||||

| 53 | |||||

| 56 | |||||

| 57 | |||||

| 60 | |||||

| 62 | |||||

Proposal 6 – Approval of Biogen Inc. 2024 Employee Stock Purchase Plan | 67 | ||||

| 70 | |||||

| 72 | |||||

| 79 | |||||

| 80 | |||||

| 80 | |||||

| 81 | |||||

| 81 | |||||

| A-1 | |||||

| B-1 | |||||

| C-1 | |||||

| D-1 |

2024 Proxy Statement 2024 Proxy Statement |

|

|

|

Proxy Statement Summary |

Proxy Statement Summary

This summary highlights important information you will find in this Proxy Statement. As it is only a summary, please review the complete Proxy Statement before you vote.

Annual Meeting Information

| ||||

DATE: |

Thursday, June | |

TIME: | 9:00 a.m. Eastern Time | |

| LOCATION: | Online only at www.virtualshareholdermeeting.com/

You will not be able to attend the annual meeting in person. | |

RECORD DATE:

| April

|

Voting Matters and Vote Recommendation

| ||||

Matter Management Proposals: | Our Board Recommendation | Page Number for more detail | ||||

| Proposal 1—Election of Directors | FOR each nominee | 2 | ||||

Proposal 2— | FOR | 22 | ||||

| Proposal 3—Advisory Vote on Executive Compensation | FOR | 25 | ||||

Proposal 4—Approvalof Amendment to our Amended and Restated Certificate of Incorporation, as Amended, to add an officer exculpation provision | 60 | |||||

| Proposal 5-—Approval of the Biogen Inc. 2024 Omnibus Equity Plan | FOR | 62 | ||||

| Proposal 6-—Approval of the Biogen Inc. 2024 Employee Stock Purchase Plan | FOR | 67 | ||||

How to Vote

| ||||

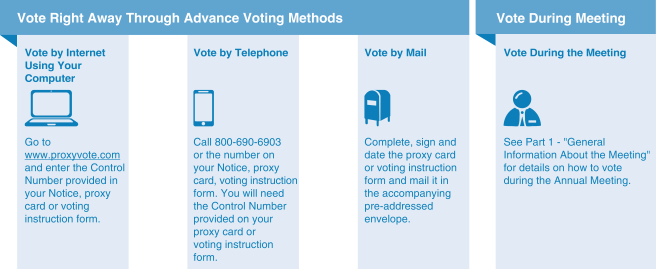

| Vote Right Away Through Advance Voting Methods | Vote During Meeting | |||||||

| Vote by Internet Using Your Computer Go to www.proxyvote.com and enter the Control Number provided in your Notice, proxy card or voting instruction form.

| |||||||

| Vote During the Meeting See Part 1 – “General Information About the Meeting” for details on how to vote during the Annual Meeting. | |||||||

| Vote by Telephone Call 800-690-6903 or the number of your Notice, proxy card, voting instruction form. You will need the Control Number provided on your proxy card or voting instruction form. | |||||||

| Vote by Mail Complete, sign and date the proxy card or voting instruction form and mail it in the accompanying pre-addressed envelope. | |||||||

| -1- |

Proposal 1 — Election of Directors |

|

Proposal 1 — Election of Directors

You are being asked to vote on the election of the following 10 nominees for director. All directors are elected annually by the affirmative vote of a majority of votes cast. Detailed information about each director’s background, skill sets and areas of expertise can be found beginning on page 1.

| ||||

| ||||

| Committee Memberships* | ||||||||||||

Name

| Age*

| Independent

| Audit

| Compensation and

| Corporate Governance

| Other

| ||||||

| Alexander J. Denner, Ph.D. | 53 | ✓ | C | 1 | ||||||||

| Caroline D. Dorsa** | 63 | ✓ | C | 3*** | ||||||||

| Maria C. Freire, Ph.D. | 68 | ✓ | M | 2 | ||||||||

| William A. Hawkins | 69 | ✓ | M | 2 | ||||||||

| William D. Jones | 67 | ✓ | C | — | ||||||||

| Jesus B. Mantas | 54 | ✓ | M | M | — | |||||||

| Richard C. Mulligan, Ph.D. | 68 | ✓ | M | 2 | ||||||||

| Eric K. Rowinsky, M.D. | 66 | ✓ | M | 3 | ||||||||

| Stephen A. Sherwin, M.D. | 74 | ✓ | M | 2 | ||||||||

| Christopher A. Viehbacher | 63 | 1**** | ||||||||||

* Age and Committee memberships are as of April 20, 2023.

** Dr. Papadopoulos is not standing for reelection at the 2023 Annual Meeting. Effective immediately after the 2023 Annual Meeting, Ms. Dorsa will become Chair of the Board.

*** Ms. Dorsa resigned from the Board of Directors of Intellia Therapeutics, Inc. The resignation will be effective on June 15, 2023.

**** Mr. Viehbacher is not standing for reelection for the Board of Directors of Puretech plc and will depart the Puretech plc Board on June 13, 2023.

“C” indicates Chair of the committee.

“M” indicates member of the committee.

|

|

We Have Implemented Corporate Governance Best Practices

We continuously monitor developments and best practices in corporate governance and consider stockholder feedback when enhancing our governance structures. Below are highlights of our key governance practices.

|

| |

|

| |

|

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF

THE 10 NAMED NOMINEES.

|

|

| ||||

Proposal 2 – Ratification of Independent Registered Public Accounting Firm

You are being asked to vote to ratify the selection of PricewaterhouseCoopers LLP (PwC) as our independent registered public accounting firm for the fiscal year ending December 31, 2023. Detailed information about this proposal can be found beginning on page 23.

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE SELECTION OF PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023.

| ||||

Proposal 3 – Advisory Vote on Executive Compensation

Our executive compensation programs are designed to drive the creation of long-term stockholder value by delivering performance-based compensation that is competitive with our peer group in order to attract and retain extraordinary leaders who can perform at high levels and succeed in a demanding business environment.

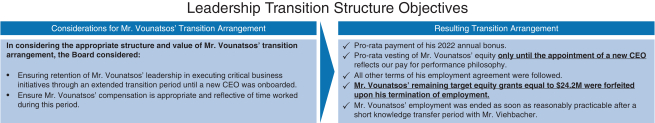

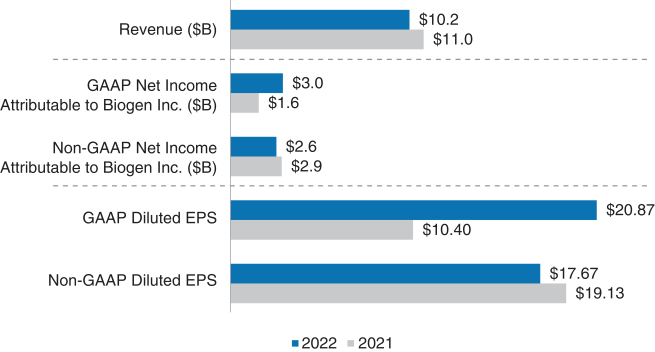

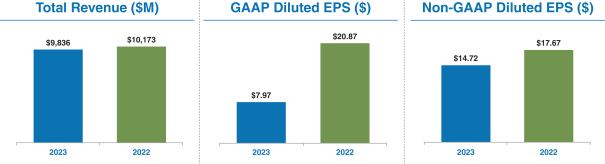

2022 Operating Performance Highlights

|

|

|

Executed key clinical studies and advanced pipeline:

|

|

We accomplished these objectives while maintaining a strategic and disciplined approach to capital allocation, aligning our cost base with revenue, and advancing our environmental sustainability, social responsibility, and corporate governance goals.

|

|

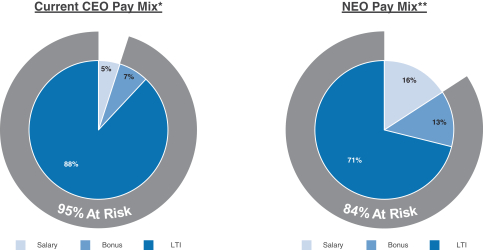

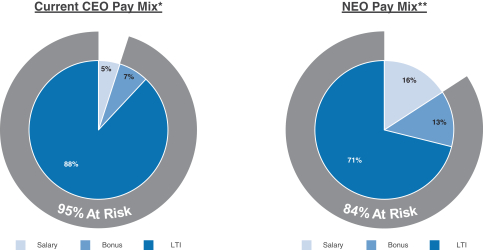

NEO Compensation is Dependent on Our Performance

A significant amount of each Named Executive Officer’s, or NEOs, compensation is at-risk and dependent on our performance and execution of our priorities.

95% of our CEO’s and 84% of our other currently employed NEOs’ (other than our CEO) 2022 target compensation was at-risk.

|

|

2022 Annual and Long-Term Award Reflect Performance Against Pre-Established Goals and Measures

Company Goals

| Weight

| Results

| Company Multiplier

| |||||||||

FINANCIAL PERFORMANCE | ||||||||||||

Revenue

Threshold $9,509M Target $10,009M Max $10,409M | 33 | % | $ | 10,326M | (1) | 139.6 | % | |||||

Non-GAAP diluted EPS

Threshold $13.75 Target $16.00 Max $17.55 | 33 | % | 17.74 | (1) | 150.0 | % | ||||||

ALZHEIMER’S DISEASE LEADERSHIP | ||||||||||||

Execute on Critical Alzheimer’s Disease Initiatives • Achievement of Lecanemab Accelerated Approval | 10 | % | At Goal | (2) | 100.0 | % | ||||||

PIPELINE DEVELOPMENT | ||||||||||||

Build and Advance Total Pipeline • Initial major market filings • Pivotal Study initiations • Research to Development transitions • Other asset advancements | 19 | % | | Above Goal | (3) | 110.0 | % | |||||

ENVIRONMENTAL, SOCIAL, GOVERNANCE | ||||||||||||

Execute on Critical ESG Strategy to Drive our Healthy Climates, Healthy Lives and DE&I Initiatives • Clinical trial recruitment strategy • Environmental initiatives • Enterprise-wide DE&I and employee engagement advancements | 5 | % | | Above Goal(4) | | 125.0 | % | |||||

Company Multiplier |

| 132.7 | %* | |||||||||

Overall Annual Bonus Plan Multiplier - Rounded to the Nearest Whole Percent |

| 133.0 | % | |||||||||

|

|

|

Notes to 2022 Annual Bonus Plan Company Performance Targets and Results Table

|

|

|

|

We have Implemented Compensation Best Practices

We also believe the Company’s practices and policies promote sound compensation governance and are in the best interests of our stockholders:

|

| |

|

| |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE ADVISORY RESOLUTION TO APPROVE THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS.

|

|

| ||||

Proposal 4. Advisory Vote on the Frequency of the Advisory Vote on Executive Compensation

In this Proposal 4 you are being asked to cast a non-binding, advisory vote on how frequently we should have say-on-pay votes in the future. You can vote to hold say-on-pay votes every one, two, or three years, or you can abstain from voting. Our Board of Directors believes that say-on-pay votes should be held annually to facilitate the highest level of accountability to, and communication with, our stockholders. Further information about this proposal can be found on page 73.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ONE-YEAR OPTION AS THE FREQUENCY OF THE ADVISORY VOTE ON EXECUTIVE COMPENSATION.

|

|

| ||||

This Proxy Statement contains forward-looking statements, including statements relating to: our strategy and plans; potential of our commercial business and pipeline programs; capital allocation and investment strategy; clinical development programs, clinical trials and data readouts and presentations; risks and uncertainties associated with drug development and commercialization; regulatory discussions, submissions, filings and approvals and the timing thereof; the potential benefits, safety and efficacy of our products and investigational therapies; and the anticipated benefits and potential of investments, collaborations and business development activities. These forward-looking statements may be accompanied by such words as “aim,” “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “potential,” “possible,” “will,” “would” and other words and terms of similar meaning. You should not place undue reliance on these statements or the scientific data presented.

These statements involve risks and uncertainties that could cause actual results to differ materially from those reflected in such statements, including the risks and uncertainties that are described in the Risk Factors section of our most recent annual or quarterly report and in other reports we have filed with the U.S. Securities and Exchange Commission (SEC). These statements speak only as of the date of this Proxy Statement. We do not undertake any obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law.

| ||||

ADUHELM®, RITUXAN®, SPINRAZA®, TECFIDERA®, and VUMERITY® are registered trademarks of Biogen. Healthy Climate, Healthy Lives™ and QALSODY™, a trademark of Biogen. LEQEMBI™ and LUNSUMIO™ and other trademarks referenced in this Proxy Statement are the property of their respective owners.

|

|

|

We are asking our stockholders to elect the 109 director nominees listed below to serve a one-year term extending until our 20242025 annual meeting of stockholders and until their successors are duly elected and qualified, unless they resign or are removed:

| Susan K. Langer | Eric K. Rowinsky | |||

| Maria C. Freire | Jesus B. Mantas | Stephen A. Sherwin | ||

| William A. Hawkins | ||||

| Christopher A. Viehbacher | ||||

Our Board of Directors has nominated these 109 individuals based on its carefully considered judgment that the experience, qualifications, attributesskills, contributions, background, diversity and skillsexperience of our nominees qualify them to serve on our Board of Directors.Board. As described in detail below, our nominees have considerable professional and business expertise. We know of no reason why any nominee would be unable to accept nomination or election. All nominees have consented to be named in this Proxy Statement and to serve if elected.

To be elected, a director nominee must receive the affirmative vote of the majority of the votes cast. Abstentions and broker non-votes, if any, are not considered votes cast under our bylaws and will have no effect on the results of this vote. For additional information please see also “What vote is required to approve each proposal and how are votes counted?” on page 75. If any nominee is unable to serve on our Board, of Directors, the sharesstock represented by your proxy will be voted for the election of such other person as may be nominated by our Board or alternatively, the number of Directors.directors may be reduced accordingly by the Board. In addition, in compliance with all applicable state and federal laws and regulations, we will file an amended proxy statement and proxy card that, as applicable, (1) identifies the alternate nominee(s) and (2) discloses that such nominees have consented to being named in the revised proxy statement and to serve if elected. As previously disclosed, Dr. Papadopoulos is not standing for reelection at the Annual Meeting. Ms. Dorsa will succeed Dr. Papadopoulos

| Nominees to the Board | Independent | Age | Director Since | Audit Committee | Corporate Governance Committee | Compensation Management Development Committee | ||||||||||||||||||||||||

Caroline D. Dorsa | ✓ | 64 | 2010 |

| C |

| ||||||||||||||||||||||||

Maria C. Freire | ✓ | 69 | 2021 |

|

| M | ||||||||||||||||||||||||

William A. Hawkins | ✓ | 70 | 2019 | C | M |

| ||||||||||||||||||||||||

Susan K. Langer | ✓ | 33 | 2023 |

|

|

| ||||||||||||||||||||||||

Jesus B. Mantas | ✓ | 55 | 2019 | M |

| C | ||||||||||||||||||||||||

Monish Patolawala | ✓ | 54 | 2024 | M |

|

| ||||||||||||||||||||||||

Eric K. Rowinsky | ✓ | 67 | 2010 |

| M | M | ||||||||||||||||||||||||

Stephen A. Sherwin | ✓ | 75 | 2010 | M |

|

| ||||||||||||||||||||||||

Christopher A. Viehbacher |

| 64 | 2022 |

|

|

| ||||||||||||||||||||||||

* Age and Committee memberships are as Chair of the Board of Directors immediately following our 2023 Annual Meeting.April 8, 2024.

Director Skills and Qualifications

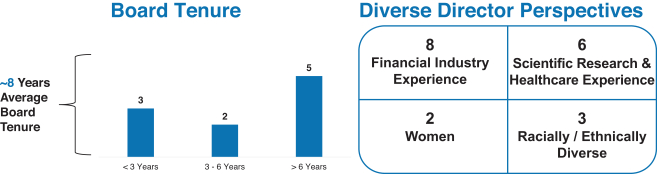

The Corporate Governance Committee believes that the 10 director nominees collectively have the skills, experience, diversity and character to execute the Board of Directors’ responsibilities. The following is a summary of those qualifications:C – Chair; M – Member

2024 Proxy Statement 2024 Proxy Statement | -2- |

Proposal 1 — Election of Directors

Summary of Director Nominee Core Experiences and Skills

Our Board consists of a diverse group of highly qualified leaders in their respective fields. Many of our directors have extensive scientific and healthcare expertise relevant to our industry. Most of our directors have executive leadership experience at large companies and have gained significant and wide-ranging management experience (including strategic and financial planning, public company financial reporting, compliance, risk management, and leadership development). Many of our directors also have public company experience (serving as chief executive officers or chief financial officers, on boards of directors and board committees), and bring an understanding of corporate governance practices and trends and unique perspectives to the Board. The Board and the CGC believe the skills, contributions, background, diversity and experience of our directors provide us with a wide range of perspectives to effectively address our evolving needs and represent the best interests of our stockholders.

Our Board possesses a deep and broad set of skills and experiences that facilitate strong oversight and strategic direction for a pioneering biotechnology company.

The following chart summarizes the competencies of each director nominee. The details of each nominee’s competencies are included in each nominee’s biography.

|  |  |  |  |  |  |  |  |  | |||||||||||||||||||||||||||||||

Business Operations Understanding of day-to-day operations enhances oversight of development, implementation and assessment of operating plans | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||

Understanding of commercialization, go-to market model and investment strategy to support continuous revenue generation |

|

|

|

|

|

|

| ✓ |

| |||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

|

| ✓ | ✓ | |||||||||||||||||||||||||||||||||||||

| ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||

|

|

| ✓ | |||||||||||||||||||||||||||||||||||||

Cybersecurity | Technology and information security knowledge enhances oversight of data management and privacy policies and processes | ✓ | ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

|

|

|

| ✓ | ✓ | |||||||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||

Drug Development Expertise of drug development increases successful navigation of highly regulated market | |

| ✓ | |||||||||||||||||||||||||||||||||||||

|

| ✓ | ||||||||||||||||||||||||||||||||||||||

|

|

| ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||

Executive Leadership Executive management experience includes thought and operational leaders who can advise on corporate strategy, values and culture | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||

Finance Financial expertise provides oversight of financial statements and capital structure decisions | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||

|

|

| ✓ |

| ✓ | ✓ | ||||||||||||||||||||||||||||||||||

International Business Global market expertise enhances oversight of strategy development and execution, supply chain and compliance across markets | ✓ | ✓ | ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||

| ✓ |

|

| ✓ | ||||||||||||||||||||||||||||||||||||

Public Board Service Corporate governance fluency ensures shareholder and stakeholders interests serve as input to discussions and informs Board decisions | ✓ | ✓ | ✓ |

|

|

| ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||

Governmental and regulatory experience assures navigation of legal/ regulatory policies and procedures as well as stakeholder expectations | ✓ | ✓ | ✓ |

| ✓ | ✓ |

| ✓ | ✓ | |||||||||||||||||||||||||||||||

Scientific Research Research experience ensures the appropriate balance between innovation and costs |

| ✓ |

|

| ||||||||||||||||||||||||||||||||||||

|

|

| ✓ | ✓ |

| |||||||||||||||||||||||||||||||||||

|

|

|

The lack of a “✓” for a particular item does not mean that the director does not possess that qualification characteristic, expertise or experience. Each of our Board members has experience and/or skills in the enumerated areas, however the “✓” indicates that a director has a particular strength in that area.

2024 Proxy Statement 2024 Proxy Statement | -3- |

Proposal 1 — Election of Directors

In compliance with NASDAQ’sThe Nasdaq Stock Market’s (Nasdaq) Board Diversity Rule, the table below provides certain highlights of the composition ofinformation about our Board members and nominees in 20222024. Our 2023 proxy statement which was filed with the U.S. Securities and 2023.Exchange Commission (SEC) on April 28, 2023, includes our 2023 Board diversity matrix.

| Board Diversity Matrix (April 21, 2022) | ||||||||

| Total Number of Directors | 13 | |||||||

|

| Female | Male | Non-Binary | Did Not Disclose Gender | ||||

| Part I: Gender Identity | ||||||||

| Directors | 3 | 10 | 0 | 0 | ||||

| Part II: Demographic Background | ||||||||

| African American or Black | 0 | 1 | 0 | 0 | ||||

| Alaskan Native or Native American | 0 | 0 | 0 | 0 | ||||

| Asian | 0 | 0 | 0 | 0 | ||||

| Hispanic or Latinx | 1 | 1 | 0 | 0 | ||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||

| White | 1 | 8 | 0 | 0 | ||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||

| LGBTQ+ | 0 | |||||||

| Did Not Disclose Demographic Background | 1 | |||||||

| Board Diversity Matrix (April | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Number of Directors | 9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|  | |||||||||||||||||||||||||||||||||||||||||||||||||

Part 1: Gender Identity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Female | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Male | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Non-Binary | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Part II: Demographic Background | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

African American or Black |

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Alaskan Native or Native American | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Asian | ✓ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Hispanic or Latinx |

|

| ✓ |

|

| ✓ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Native Hawaiian or Pacific Islander | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||

White | ✓ |

| ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Two or More Races or Ethnicities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LGBTQ+ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Did |

|

| ✓ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2024 Proxy Statement 2024 Proxy Statement |

|

|

Proposal 1 — Election of Directors |

Our Nominees for Director

(Information is as of April 28, 2023)

| ||

|

| |

Experience

Dr. Denner is a founding partner and Chief Investment Officer of Sarissa Capital Management LP, a registered investment advisor, which he founded in 2012. Sarissa Capital focuses on improving the strategies of companies to enhance stockholder value. From 2006 to 2011, Dr. Denner served as a Senior Managing Director at Icahn Capital L.P. Prior to that, he served as a portfolio manager at Viking Global Investors, a private investment fund, and Morgan Stanley Investment Management, a global asset management firm.

Qualifications

Dr. Denner has significant experience overseeing the operations and research and development functions of healthcare companies and evaluating corporate governance matters. He also has extensive experience as an investor, particularly with respect to healthcare companies, and possesses broad healthcare industry knowledge.

Other Current Public Company Boards

– Ironwood Pharmaceuticals, Inc.

Former Public Company Directorships Held in the Past Five Years

– Ariad Pharmaceuticals, Inc. (Chair)

– Bioverativ Inc.

– Sarissa Capital Acquisition Corp. (Chair)

– The Medicines Company (Chair)

| ||

|

| |

Experience

Ms. Dorsa served as the Executive Vice President and Chief Financial Officer of Public Service Enterprise Group Incorporated, a diversified energy company, from April 2009 until her retirement in October 2015, and served on its Board of Directors from February 2003 to April 2009. From February 2008 to April 2009, she served as Senior Vice President, Global Human Health, Strategy and Integration at Merck & Co., Inc., a pharmaceutical company. From November 2007 to January 2008, Ms. Dorsa served as Senior Vice President and Chief Financial Officer of Gilead Sciences, Inc., a life sciences company. From February 2007 to November 2007, she served as Senior Vice President and Chief Financial Officer of Avaya, Inc., a telecommunications company. From 1987 to January 2007, Ms. Dorsa held various financial and operational positions at Merck & Co., Inc., including Vice President and Treasurer, Executive Director of U.S. Customer Marketing and Executive Director of U.S. Pricing and Strategic Planning.

Qualifications

Ms. Dorsa has significant financial and accounting expertise and a deep knowledge of the pharmaceutical industry. Her strategic perspective on the industry is particularly valuable to our Board of Directors as it oversees our growth initiatives and reviews both internal development projects and external opportunities.

Other Current Public Company Boards

– Duke Energy

– Illumina, Inc.

– Intellia Therapeutics, Inc. (resigned from the Board of Directors of Intellia Therapeutics, Inc. effective June 15, 2023.)

Former Public Company Directorships Held in the Past Five Years

– Goldman Sachs Investment Funds

|

|

|

| ||||

|

| |||

Experience

From November 2012 to September 2021, Dr. Freire served as President and Executive Director and as a member of the Board of Directors of the Foundation for the National Institutes of Health. From March 2008 to November 2012, she served as President and as a member of the Board of Directors of the Albert and Mary Lasker Foundation. Prior to joining the Lasker Foundation, Dr. Freire served as President and Chief Executive Officer of the Global Alliance for TB Drug Development from 2001 to 2008 and Director of the Office of Technology Transfer at the National Institutes of Health from 1995 to 2001. She has served on the boards of numerous national and international organizations, including the Science Board of the U.S. Food and Drug Administration, the World Health Organization Commission on Intellectual Property Rights, Innovation and Public Health and the United Nations Secretary General’s High Level Panel on Access to Medicines. Dr. Freire also serves on the Board of Koneksa Health, a private company that develops, tests and validates digital biomarkers for clinical trials. Dr. Freire is also a member of the National Academy of Medicine and the Council on Foreign Relations, and she is the recipient of numerous awards, including a 2017 Gold Stevie Award for “Woman of the Year,” the U.S. Department of Health and Human Services Secretary’s Award for Distinguished Service, the Arthur S. Fleming Award and the Bayh-Dole Award. Dr. Freire holds a Ph.D. in Biophysics from the University of Virginia and a B.S. from the Universidad Peruana Cayetano Heredia in Lima, Peru.

Qualifications

Dr. Freire has significant knowledge and experience with respect to medical research, the pharmaceutical industry and government healthcare policymaking. Dr. Freire’s strong public policy and government experience also provides vital insights to our Board of Directors about significant issues affecting the highly regulated life sciences industry.

Other Current Public Company Boards

– Alexandria Real Estate Equities, Inc.

– Exelixis, Inc.

Former Public Company Directorships Held in the Past Five Years

– None

| ||||

|

| |||

Experience

Mr. Hawkins serves as a Senior Advisor to EW Healthcare Partners, a life sciences private equity firm. Mr. Hawkins is the former Chairman and CEO of Medtronic, Inc., a global leader in medical technology. He was at Medtronic from 2002 until 2011. After retiring from Medtronic, he served as President and Chief Executive Officer of Immucor, a private equity backed global leader in transfusion and transplant medicine from October 2011 to July 2015. From 1998 to 2001 Mr. Hawkins served as President and Chief Executive Officer of Novoste Corporation, an interventional cardiology company. Prior to that, Mr. Hawkins served in a variety of senior roles at American Home Products, a consumer, pharma and medical device company, Johnson & Johnson, a healthcare company, Guidant Corporation, a medical products company, and Eli Lilly and Company, a global pharmaceutical company. Mr. Hawkins also serves on the boards of Virtue Labs, Cereius, Enterra, Cirtec Medical Corp., Baebies, Inc. and Immucor, all of which are life science companies. Mr. Hawkins is Vice Chair of the Duke University Board of Trustees and is Chair of the Duke University Health System. Mr. Hawkins was elected as a member of the AIMBE College of Fellows and the National Academy of Engineering. He has a dual degree in Electrical and Biomedical Engineering from Duke University and a M.B.A. from the University of Virginia’s Darden School of Business.

Qualifications

Mr. Hawkins has significant leadership experience as a chief executive officer, significant knowledge of, and experience in, the healthcare industry and significant international experience. He also has extensive governance and public company board experience.

Other Current Public Company Boards

– Bioventus Inc. (Chairman)

– MiMedx Group, Inc.

Former Public Company Directorships Held in the Past Five Years

– Avanos Medical, Inc.

– Thoratec Corporation

|

|

|

| ||||

|

| |||

Experience

William Jones is the Managing Member of CityLink LLC, an investment and consulting firm. He is the former President/CEO of CityLink Investment Corporation, a commercial real estate company he formed in 1994 that earned national acclaim for developing complex private and public urban projects. He served as President/CEO of City Scene Management Company from 2001 through 2018. Prior to that, Mr. Jones served as Investment Manager of certain Prudential real estate subsidiaries and as General Manager/Senior Asset Manager overseeing more than 2 million square feet of office, retail, industrial and multi-family properties in three states. Earlier in his career, he served in San Diego city government as a City Council Member, Deputy Mayor and Chief of Staff to City Council Member Leon Williams. Mr. Jones is an independent director and board chair of certain funds managed by the Capital Group with net assets of approximately $600 billion and former chairman of the Audit and Nominating/Governance committees. Mr. Jones is an independent director of Global Infrastructure Solutions Inc., a private global engineering and construction services company and chairs its Compensation and Organization Committee and is its Lead Valuation Director. He is a trustee of the UC San Diego Foundation Board and a member of its Investment Committee and Real Estate Advisory Council. Mr. Jones is a National Association Corporate Director Board Leadership Fellow and is listed in the 2019 NACD Directorship 100. He was honored as one of the nation’s “Most Influential Black Corporate Directors” by Savoy Magazine in 2021.

Qualifications

Mr. Jones has extensive leadership experience in business, not-for profit boards and government, and provides vital insights to our Board of Directors about governance and significant issues affecting the highly regulated life sciences industry. He brings financial, corporate governance and public policy sector expertise to our Board of Directors.

Other Current Public Company Boards

– None

Former Public Company Directorships Held in the Past Five Years

– Sempra Energy

| ||||

|

| |||

Experience

Mr. Mantas serves as the Global Managing Partner responsible for IBM Business Transformation Services unit of IBM, and he is also responsible for IBM Consulting Corporate Development. Mr. Mantas is a member of the IBM Executive Performance Team, IBM Executive Technology Team and IBM Chairman Acceleration Team and is the Emeritus Chair of the IBM Hispanic Diversity Council. He served in the Global AI Council of the World Economic Forum, serves on the board of HITEC, a non-profit organization focused on developing and advancing the careers of Hispanic executives in the Technology Industry and on the board of NACME (National Action Council for Minorities in Engineering). He is a limited partner to Benhamou Global Ventures Fund IV, an investment fund for early-stage companies focusing on digital transformation, and is an active investor in Hispanic-led early stage companies. From 2002 through 2016, Mr. Mantas led IBM’s Business Consulting unit, one of the largest consulting organizations in the world. Prior roles included leading IBM Global Process Services and the Business Services unit in Latin America after he held multiple leadership positions as Vice President in North America. Before joining IBM, Mr. Mantas was a Partner in PricewaterhouseCoopers Consulting, an adjunct professor at University of California Irvine – Graduate School of Management and an officer in the Air Force of Spain.

Qualifications

Mr. Mantas has significant global operating, business and technology leadership experience across Europe, North America and Latin America. He has demonstrated leadership designing new strategies and translating them into execution, applying technology to improve business performance, advocating for diversity and developing talent in multi-cultural environments. He brings over 30 years of experience in information technology, data science and artificial intelligence.

Other Current Public Company Boards

– None

Former Public Company Directorships Held in the Past Five Years

– None

|

|

|

| ||||

|

| |||

Experience

Dr. Mulligan is currently the Mallinckrodt Professor of Genetics, Emeritus, at Harvard Medical School, after serving as the Mallinckrodt Professor of Genetics and Director of the Harvard Gene Therapy Initiative from 1996 to 2013. He also currently serves as the Head of SanaX, a division of the research department of Sana Biotechnology, Inc. (Sana), a biotechnology company. From March 2017 to October 2018, Dr. Mulligan served as a Portfolio Manager at Icahn Capital LP. Prior to that, Dr. Mulligan was a founding partner of Sarissa Capital Management LP, a registered investment advisor, from 2013 to 2016. Prior to Harvard, Dr. Mulligan was a Professor of Molecular Biology at the Massachusetts Institute of Technology, a member of the Whitehead Institute for Biomedical Research and the Chief Scientific Officer of Somatix Therapy Corporation, a drug discovery and development company that he founded. Dr. Mulligan was named a MacArthur Foundation Fellow in 1981.

Qualifications

Dr. Mulligan has scientific expertise in the areas of molecular biology, genetics, gene therapy and biotechnology as well as extensive experience within the healthcare industry, including overseeing the operations and research and development of healthcare companies.

Other Current Public Company Boards

– Sana Biotechnology, Inc. (Vice Chairman)

– Bausch Health Companies

Former Public Company Directorships Held in the Past Five Years

– None

| ||||

|

| |||

Experience

Dr. Rowinsky’s professional career has been focused on the development and registration of new therapeutics of all types. He has played an integral role and has led teams that have registered more than twelve novel therapies for patients with advanced cancers. He has been an independent consultant to the biopharmaceutical industry since 2010. Dr. Rowinsky has served as President of Inspirna, Inc., a privately-held life sciences company, since November 2015 and previously served as its Executive Chairman from December 2016 to September 2021. He has served as Chief Medical Officer of Hummingbird Biotherapeutics, a private life-science company focusing on discovery of novel targets and protein therapeutics for cancer and autoimmune diseases from January 2020 to March 2023. From June 2016 to June 2021, he served as the Chief Scientific Officer of Clearpath Development Inc., which rapidly advances development stage therapeutic assets to pre-defined human proof-of-concept milestones. From January 2012 to November 2015, he was the Head of Research and Development and Chief Medical Officer of Stemline Therapeutics, Inc., a biotechnology company focusing on the discovery and development of therapeutics targeting cancer stem cells and rare diseases. Prior to that, he was the Chief Executive Officer of Primrose Therapeutics, Inc., a start-up biotechnology company focusing on the development of therapeutics for polycystic kidney disease, from August 2010 until its acquisition in September 2011. From 2005 to December 2009, he served as the Chief Medical Officer and Executive Vice President of ImClone Systems Inc, a life sciences company. From 1996 to 2004 he held several positions at the Cancer Therapy & Research Center’s Institute for Drug Development, including Director of the Institute and Director of Clinical Research. From 1988 to 1996 he was an Associate Professor of Oncology at the Johns Hopkins School of Medicine. Dr. Rowinsky has also served on the Board of Scientific Counselors of the National Cancer Institute.

Qualifications

Dr. Rowinsky has extensive research and drug development and regulatory experience and broad scientific and medical knowledge.

Other Current Public Company Boards

– Fortress Biotech Inc.

– Purple Biotech Ltd.

– Verastem, Inc.

Former Public Company Directorships Held in the Past Five Years

– BIND Therapeutics, Inc.

|

|

|

| ||||

|

| |||

Experience

Dr. Sherwin currently divides his time between advisory work in the life sciences industry and patient care and teaching in his specialty of medical oncology. He is a Clinical Professor of Medicine at the University of California, San Francisco and a volunteer Attending Physician in Hematology-Oncology at the Zuckerberg San Francisco General Hospital. Dr. Sherwin also currently serves as an advisory partner with Third Rock Ventures, LLC. He previously served as the Chairman of Ceregene, Inc., a life sciences company that he co-founded, from 2001 until its acquisition by Sangamo Biosciences, Inc. in 2013. He was also a co-founder and chairman of Abgenix, Inc., an antibody company which was acquired by Amgen Inc. in 2006. From 1990 to October 2009, he served as the Chief Executive Officer of Cell Genesys, Inc., a life sciences company, and was its Chairman from 1994 until the company’s merger with BioSante Pharmaceuticals, Inc. (now ANI Pharmaceuticals, Inc.) in October 2009. Prior to that, he held various positions at Genentech, Inc., a life sciences company, most recently as Vice President, Clinical Research. In addition, Dr. Sherwin previously served on the Board of Directors of the Biotechnology Industry Organization from 2001 to 2014 and as its chairman from 2009 to 2011.

Qualifications

Dr. Sherwin has extensive knowledge of the life sciences industry and brings more than 30 years of experience in senior leadership positions at large and small publicly traded life sciences companies to our Board of Directors.

Other Current Public Company Boards

– Neurocrine Biosciences, Inc.

– Bios Special Acquisition Corporation

Former Public Company Directorships Held in the Past Five Years

– Epiphany Technology Acquisition Corp.

– Aduro Biotech, Inc

| ||||

|

| |||

Experience

Mr. Viehbacher has served as our President and Chief Executive Officer and member of our Board of Directors since November 2022. Prior to joining Biogen, Mr. Viehbacher served as Managing Partner of Gurnet Point Capital, a Boston based investment fund, from 2015 to 2022. Prior to that, Mr. Viehbacher served as Global CEO of Sanofi S.A., from 2008 to 2014. Prior to joining Sanofi, Mr. Viehbacher spent over 20 years with GlaxoSmithKline in Germany, Canada, France and, latterly, the U.S. as President of its North American pharmaceutical division. Mr. Viehbacher began his career with PricewaterhouseCoopers LLP and qualified as a chartered accountant. He is also a trustee of Northeastern University and a member of the Board of Fellows at Stanford Medical School.

Qualifications

Mr. Viehbacher has extensive international experience in both large pharmaceutical companies and entrepreneurial biotech companies. Mr. Viehbacher brings a keen understanding of the complexities involved in running a multibillion-dollar global pharmaceutical business as well as an appreciation for the value of innovation.

Other Current Public Company Boards

– Pure Tech plc (Chair), not standing for reelection and departing the Pure Tech plc Board of Directors on June 13, 2023.

Former Public Company Directorships Held in the Past Five Years

– Axcella Health

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERSA VOTE “FOR” EACH OF THE NAMED NOMINEES. PROXIES WILL BE VOTED “FOR” THE ELECTION OF EACHTHE NOMINEES UNLESS OTHERWISE SPECIFIED.

DIRECTOR NOMINEE NAMED ABOVE.

|

|

|

CommitteesSet forth below is biographical information for each nominee and Meetings

Our Boarda summary of Directors met 15 times in 2022. Our Board of Directors also has three standing committees. The principal functions of each committee, the committee composition as of December 31, 2022,specific skills, contributions, background and the number of meetings held in 2022 are described in the table below. The Chair of each committee periodically reports toexperiences which led our Board of Directorsto conclude that each nominee should serve on committee deliberations and decisions. The charter of each of our committees is posted on our website, www.biogen.com, under the “Corporate Governance” subsection of the “Investors” section of the website. Also posted there are our Corporate Governance Principles, which, together with our committee charters, comprise our governance framework.Board at this time.

Caroline Dorsa, Independent Chair, fmr. Chief Financial Officer of Public Service Enterprise Group | ||||||

| Director since 2010 Age 64 Board Committee Corporate Governance (Chair)

• Business Operations • Commercial • Cybersecurity • Executive Leadership • Finance • International Business • Public Board Service • Public Policy

|

Ms. Dorsa has deep knowledge of the pharmaceutical industry as well as significant financial and accounting expertise. Her strategic perspective on the industry enhances the Board’s oversight of the company’s growth initiatives and reviews of both internal development projects and external opportunities. Career Highlights • Executive Vice President (EVP) and Chief Financial Officer (CFO), Public Service Enterprise Group, Inc. (2009 – 2015) • Senior Vice President (SVP) of Global Human Health, Strategy and Integration, Merck & Co., Inc. (2008 – 2009) • SVP and CFO, Gilead Sciences, Inc. (2007 – 2008) • Various financial and operational positions at Merck & Co., Inc. including Vice President and Treasurer (1987 – 2007) Other Public Company Boards Current • Illumina, Inc. (since 2010) • Duke Energy Corporation (since 2021) Prior • Intellia Therapeutics, Inc (2015 – 2023) • Goldman Sachs Funds (2016 – 2021) • Public Service Enterprise Group, Inc. (2003 – 2009) Education • B.A. in History from Colgate University • M.B.A. in Finance and Accounting from Columbia University | ||||

Maria C. Freire, Ph.D., fmr. President and Executive Director, Foundation for the National Institutes of Health | ||

Director since 2021 Age 69 Board Committee Compensation and Management Development Key Skills • Business Operations • Drug Development • Executive Leadership • Finance • International Business • Public Board Service • Public Policy • Scientific Research

|

Dr. Freire has significant knowledge and experience with respect to medical research, the pharmaceutical industry and government healthcare policymaking. Dr. Freire’s strong public policy and government experience vitally enhances the Board’s perspective of significant issues affecting the highly regulated life sciences industry. Career Highlights • President and Executive Director, the Foundation for the National Institutes of Health (“NIH”) (2012 – 2021) • President and Director, Albert and Mary Lasker Foundation (2008 –2012) • President and CEO, Global Alliance for TB Drug Development (2001 –2008) • Director of the Office of Technology Transfer, NIH (1995 – 2001) Other Public Company Boards Current • Alexandria Real Estate Equities, Inc. (since 2012) • Exelixis, Inc. (since 2018) Other Boards & Awards • Science Board of the FDA • World Health Organization Commission on Intellectual Property Rights, Innovation and Public Health, United Nations Secretary General’s High-Level Panel on Access to Medicines • Member, National Academy of Medicine and the Council on Foreign Relations • 2017 Gold Stevie Award for “Woman of the Year,” the U.S. Department of Health and Human Services Secretary’s Award for Distinguished Service, the Arthur S. Fleming Award and the Bayh-Dole Award Education • B.S. from the Universidad Peruana Cayetano Heredia (Lima, Peru) • Ph.D. in Biophysics from the University of Virginia | |

2024 Proxy Statement 2024 Proxy Statement | -5- |

Proposal 1 — Election of Directors

William A. Hawkins, fmr. Chairman and Chief Executive Officer, Medtronic, Inc. | ||||||

|

Age 70 Board Committees Audit Corporate Governance Key Skills • Business Operations • Commercial • Executive Leadership • Finance • International Business • Public Board Service • Public Policy

| Relevant Expertise

|

Career Highlights • Senior Advisor to EW Healthcare Partners, a life sciences private equity firm (since 2017) • President and CEO, Immucor, a global leader in transfusion and transplant medicine (2011 – 2015) • Chairman and CEO, Medtronic, Inc. (2002 – 2011) • President and CEO, Novoste Corporation, an interventional cardiology company (1998 – 2001) Other Public Company Boards Current • Chair, Bioventus, Inc. (since 2016) • MiMedx Group, Inc. (since 2020) Prior • Avanos Medical, Inc. (2015 – 2021) • Thoratec Corporation (2011 – 2015) Other Boards & Awards • Director, Virtue Labs, Enterra, Lacuna Medical, Cirtec Medical Corp. and Baebies, Inc., all private life companies • Duke University Health System • Member, National Academy of Engineering, and AIMBE College of Fellows Education • B.Sc. in Electrical and Biomedical Engineering (dual) from Duke University • M.B.A. from the University of Virginia’s Darden School of Business | |||

Susan Langer, President & Chief Business Officer at Souffle Therapeutics | ||||||

|

|

|

| |||

|

•

| Relevant Expertise

Ms. Langer has significant experience and knowledge of the biopharmaceutical industry and deep connections within the biotechnology, start-up and venture capital ecosystems. That expertise, coupled with her knowledge of the company’s operations, enhances the Board’s ability to nimbly evaluate growth opportunities as well as long-term investments. Career Highlights • President and Chief Business Officer, Souffle Therapeutics (since 2021) • Founding President, Kojin Therapeutics (2020 – 2021) • Chief Business Officer, Paratus Sciences (2021 – 2023) • Director, Guava Partners (since 2021) • Venture Partner, Old Silver VC LLC (2020 – 2023) • Head of Corporate Strategy and other roles at Biogen (2013 – 2019) Other Public Company Boards • None Education • B.A. in Science & Technology Studies from Cornell University | ||||

2024 Proxy Statement 2024 Proxy Statement | -6- |

Proposal 1 — Election of Directors

Jesus B. Mantas, Global Managing Partner, IBM Business Transformation Services | ||

Age 55 Board Committees Compensation and Management Development (Chair) Audit Key Skills • Business Operations • Commercial • Cybersecurity • Executive Leadership • International Business • Public Policy | ||

Mr. Mantas has over 30 years of experience in global business operations, information technology, data science and artificial intelligence gained through global strategy and operating management roles across Europe, North America and Latin America. His expertise enhances Board perspectives on global operating scale, business strategy, culture change, managing risks, applying technology to improve business performance, seeking diversity and developing talent and succession plans in multi-cultural environments. Career Highlights • Global Managing Partner, IBM Global Business Services (since 2022) • Senior roles at IBM (2002 – 2022) including: ○ Global Managing Partner, Strategy, Innovation and Corporate Development ○ Global Managing Partner, IBM Business Consulting ○ General Manager, IBM Business Process Outsourcing ○ Managing Partner and General Manager, IBM Global Business Services Latin America ○ Senior Partner, IBM Global Business Services • Partner, High Technology Practice, PricewaterhouseCoopers Consulting (1997 – 2002) • Adjunct Professor, University of • Second Lieutenant, Air Force of Spain (1993) Other Public Company Boards • None Education • B.S. in Telecommunications – Software Engineering, Universidad Politécnica de Madrid (Madrid, Spain) • Degree in Business Administration, Universidad Politécnica de Madrid (Madrid, Spain) • Corporate Governance – Harvard Business School |

Monish Patolawala, President and Chief Financial Officer at 3M Company | ||

Director since 2024 Age 54 Board Committee Audit Key Skills • Business Operations • Commercial • Cybersecurity • Executive Leadership • Finance • International Business • Public Policy | Relevant Expertise Mr. Patolawala has more than 25 years of experience leading financial operations and business for global industrial and healthcare companies. At 3M, he leads finance, enterprise strategy, information technology, global service centers, country prioritization and governance, and the company’s project management office, which includes responsibility for the execution of the spin-off of 3M’s health care business. Career Highlights • President and CFO, 3M Company (since 2020) • CFO of GE Healthcare (2015 – 2020) • Variety of roles of increasing responsibility at General Electric Company (1994 – 2020) Other Public Company Boards • None Certifications • Chartered Accountant from the Institute of Chartered Accountants of India • Cost and Works Accountant from the Institute of Cost and Works Accountants of India Education • B. Com from St. Joseph’s College of Commerce (Bangalore, India) | |

2024 Proxy Statement 2024 Proxy Statement | -7- |

Proposal 1 — Election of Directors

Eric K. Rowinsky, M.D., President of Inspirna | ||

Director since 2010 Age 67 Board Committees Compensation and Management Development Corporate Governance Key Skills • Business Operations • Drug Development • Executive Leadership • Public Board Service • Scientific Research | Relevant Expertise Dr. Career Highlights • President, Inspirna, a privately held life science company (since 2015), and Executive Chairman (2016 – 2021) • Chief Medical Officer, Hummingbird Biotherapeutics (2020 – 2023) • Chief Scientific Officer, Clearpath Development, Inc. (2016 – 2021) • Head of R&D, Chief Medical Officer, Stemline Therapeutics (2012 – 2015) • CEO, Primrose Therapeutics, Inc., a biotech start-up (2010 – 2011) • Chief Medical Officer, and Executive Vice President, ImClone Systems (2005-2010) Other Public Company Boards Current • Fortress Biotech Inc. (2010 to June 2024) (not standing for reelection at the • Purple Biotech Ltd. (since 2019) • Verastem, Inc. (since 2017) Prior • BIND Therapeutics, Inc. (2014 – 2016) Other Boards & Awards • Director of the • Associate Professor of Oncology at the • Director, Scientific Counselors of the National Cancer Institute Level Panel on Access to Medicines Education • B.A. in Liberal Arts, from New York University • M.D. from Vanderbilt University School of Medicine | |

Stephen A. Sherwin, M.D., Clinical Professor of Medicine at UCSF | ||

Director since 2010 Age 75 Board Committee Audit Key Skills • Business Operations • Drug Development • Executive Leadership • Finance • Public Board Service • Public Policy • Scientific Research |

Dr. Sherwin has extensive knowledge of the Career Highlights • Clinical Professor of Medicine at the • Volunteer Attending Physician in Hematology-Oncology at the Zuckerberg San Francisco General Hospital (since 2010) • Advisory partner, Third Rock Ventures, LLC (since 2016) • Chairman and Co-founder, Ceregene, a life sciences company acquired by Sangamo Biosciences (2001 – 2013) • Chairman and Co-founder, Abgenix, Inc, an antibody company acquired by Amgen (1996 – 2006) • CEO, Cell Genesys, Inc., a life sciences company merged with BioSante Pharmaceuticals, Inc. (now ANI Pharmaceuticals, Inc.) (1994 – 2009) Other Public Company Boards Current • Neurocrine Biosciences Inc. (since 1999) Prior • Epiphany Technology Acquisition Corp. (2022 to 2023) • Bios Special Acquisition Corporation (2021 to 2023) • Aduro Biotech, Inc (2015 – 2020) Education • B.A., in Biology from Yale University • M.D. from Harvard Medical School | |